Summary

Executive Summary

- The government issued a Presidential Regulation as a legal basis of electric-powered vehicle development. The regulation includes plans to provide fiscal and non-fiscal incentives for electric vehicle developers, with several detailed requirements.

- Several companies from domestic, China, as well as South Korea, had expressed their interest to participate in developing electric cars in Indonesia. Some had even started manufacturing plant construction.

- The government appoints PT PLN to prepare a Public Electricity Provider Station (SPLU). The State-Owned electricity company is allowed to cooperate with other companies in realizing the mandate.

Overview

Electric Car Development in Indonesia

The government unveiled the plan to develop the domestic electric-powered automotive industry. On August 8, 2019, the government issued Presidential Regulation No. 55/2019 on the Acceleration of the Battery Electric Vehicle (KBL) Program for Road Transportation as a reference for the plan.

The regulation emphasizes the government's seriousness in presenting energy-efficient and environmentally-friendly vehicles, adding that it also plans to restrict fossil fuel vehicles as stated in the Presidential Regulation, although the target is not explicitly said.

Energy security and environmental quality improvement are the two main reasons for developing electric vehicles. Ministry of Industry research on (2018) revealed that electric cars could save energy use by up to 80 percent compared to fossil fuel vehicles.

The research titled "Indonesia Electrified Vehicle Study" explained that the transportation sector was the highest fuel consumer with portions reaching 80 percent, much higher than consumptions in the household, commercial, industrial, and other sectors.

In terms of environmental issues, the study showed the transportation sector was the second-largest emitter of greenhouse gas (24.71 percent) in 2016, stood after energy-producing industries, such as electricity, which contributed 47.81 percent to emission. This is in line with the amount of fuel consumed by the transportation sector.

Based on these reasons, the government is committed to developing electric cars in Indonesia. The Presidential Regulation will be a legal basis for other legal products, particularly those related to fiscal and other incentives, as well as for any condition set.

Through the Presidential Regulation, the government has also established a team to oversee the realization of the electric car project. Below are the details of the group referred to as "The Battery Electric Vehicle Program Acceleration Coordination Team for Road Transportation."

Chairperson: Coordinating Minister for Maritime Affairs

Deputy: Coordinating Minister for Economic Affairs

Member:

- Finance Minister

- Minister of Research, Technology, and Higher Education

- Industry Minister

- Trade Minister

- Minister of Energy and Mineral Resources

- Transportation Minister

- Minister of Environment and Forestry

- Minister of Home Affairs

- Indonesian Police Chief

Source: Presidential Regulation No. 55/2019.

Automotive Industry Roadmap

Staged Production of Electric Cars in Indonesia

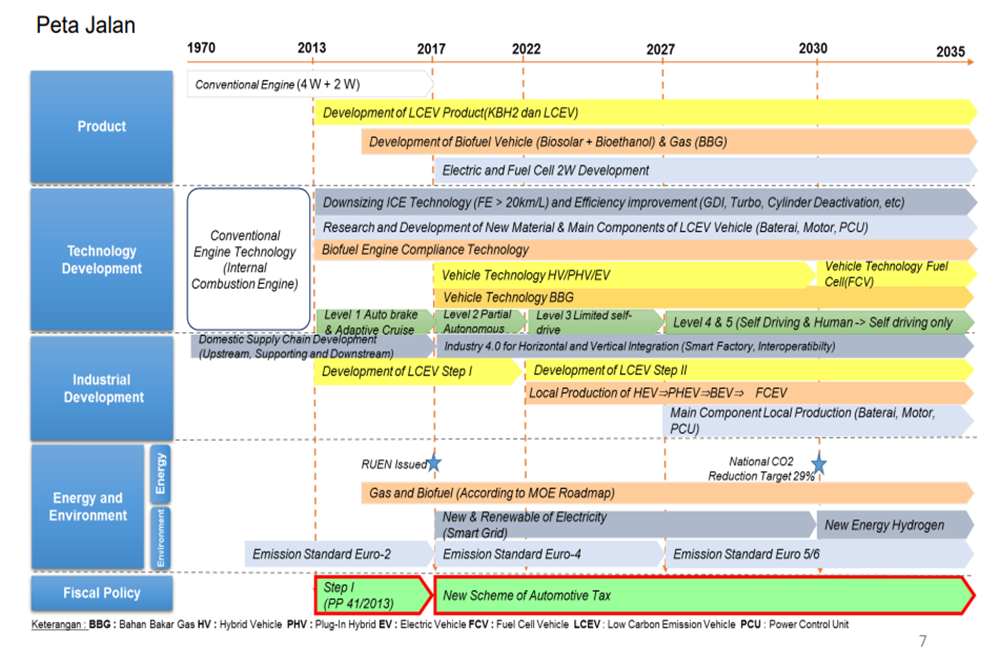

The Ministry of Industry had prepared a 2035 roadmap for the automotive industry, which serves as an essential part of Industry 4.0 Roadmap implementation.

According to the roadmap, the development of electric vehicle is carried out in stages, starting from hybrid vehicles manufacture by 2022, and will be followed with battery-electric cars and cell-powered cars.

The electric car's development is listed in the Low Carbon Emission Vehicle (LCEV). The tagline is used for broader product coverage since adjustments are needed to develop electric cars, preceded by charging infrastructure for Battery Electric Vehicles (BEV).

The LCEV also listed Fuel-Saving Motor Vehicle (KBH2), a plug-in hybrid that combines conventional engines and electric motors, before the fully-electric car. The government is aware that battery electric vehicles urgently need charging stations; thus, a transition through hybrid products is required.

Indonesian Automotive Development Road Map

Overseas Electric Cars

The International Electric Agency (IEA) noted that global electric car sales reached 1.98 million units in 2018, growing 68 percent over the previous year and adding to the existing global electric cars to 5.12 million units.

Of these, China has the largest electric car population in the world, reaching around one million units, followed by Europe with 385,000 units and the US by 361,000 units.

In terms of market share, Norway has the largest electric car market share by up to 48 percent of the total car market, followed by Iceland with 17 percent and Sweden by eight percent.

China also has the world's fastest-growing rate of electric car population, soaring to 2,3 million units in 2018 from only 100,000 units in 2014.

World's Electric Car Stock Evolution

(in million units)

|

| China | Europe | United States | Other countries |

| 2018 | 2.3 | 1.2 | 1.1 | 0.5 |

| 2017 | 1.2 | 0.9 | 0.8 | 0.3 |

| 2016 | 0.6 | 0.6 | 0.6 | 0.2 |

| 2015 | 0.3 | 0.4 | 0.4 | 0.2 |

| 2014 | 0.1 | 0.2 | 0.3 | 0.1 |

| 2013 | - | 0.1 | 0.2 | 0.1 |

Source: Evolution of the Global Electric Car Stock, IEA (2018)

Jack Barkenbus, a researcher from the Vanderbilt Institute for Energy & Environment, who conducted a particular study on the development of the electric car, confirmed that battery is the most expensive part of an electric vehicle. At present, China has produced more than half of the world's batteries demands for electric cars.

Therefore, he believed that the world electric car revolution would not come from the US, but China instead. With the country's ability to produce inexpensive electric batteries, electric car prices would possibly be cheaper than fossil fuel cars in the next five years.

The Barkenbus research published in "The Conversation" (2019) estimates that China produces 70 percent of electric car batteries circulating globally by 2021, as the country seems the readiest to provide the essential components of electric cars.

China's presence in the electric car industry has indeed suppressed batteries prices calculated per unit of energy, going down to US$ 176 per kilowatt-hour (kWh) in 2018 from whopping US$ 1,160 per kWh in 2010.

China's focus on developing the electric automotive industry is based on the awareness that the country will find it difficult to compete with established producers of fossil-fueled vehicles. Therefore, developing environmentally-friendly vehicles opens up an opportunity to compete in the global automotive industry.

Chinese government includes electric cars in one of 10 commercial sectors to be developed with the "Made in China" spirit. This commitment is manifested in the government subsidies to domestic electric car manufacturers, including subsidies to encourage people's purchasing power.

To support the development of electric cars, the Chinese government issued a new policy in 2018, called the dual credit regulatory system, which provides awards and fines for car manufacturers based on a point credit system. The government gives low credit scores for fossil-fueled cars and the highest for the electric vehicle.

The minimum annual credit point standard can only be achieved if the car manufacturer produces at least 10 percent of electric cars from its total car production. Unless the minimum standard credit point is not reached, car manufacturers will pose several consequences, such as the termination of production/sales license.

Referring to the scheme developed by electric car-producing countries, Indonesia seems inclined to the Chinese model with its subsidy approach, as seen from the fiscal and non-fiscal incentives promised in the Presidential Regulation, including the incentives for raw material imports.

The approach outlined in the regulation is only limited to the supply-side, such as by providing production-related incentives to producers. Until now, there has been no incentive plan to encourage demands, such as the convenience for consumers to switch from using fossil-fueled cars to electric cars.

Legal Framework

Presidential Regulation (Perpres) No. 55/2019 on the Acceleration of the Battery Electric Vehicle Program for Road Transportation.

This regulation is the primary legal basis in the battery electric vehicle development for road transportation. In this regulation, the central and regional governments promise fiscal and non-fiscal incentives for national-brand electric vehicle development companies, namely the Battery Electric Vehicle which use signs, images, logos, names, and words portraying Indonesian characteristic.

The following are these incentives:

| Battery Electric Vehicle Components Industry |

| · Established under Indonesian law and operates in Indonesia · Has an industrial business license to assemble or manufacture main components or supporting components for battery electric vehicles.

|

| The battery-electric vehicle industry to establish a manufacturing facility |

| Types of Fiscal Incentives: · Import duty · Sales tax on luxury goods · Central and Regional Tax Exemption or Reduction · Import duty on the imports for engines, products, and materials used for Investment · Temporary exemption of import duty for export · Government-borne import duty for importing production raw materials · The construction of Public Electric Vehicle Charging Station (SPKLU) · Support for SPKLU Infrastructure Development Financing · Electricity charge cost relief at SPKLU · Fiscal Incentives for Research, Development, and Technology Innovation Activities and Battery Electric Vehicles Component Vocations · Certification: Human Resources and Products |

| Domestic Content Level (TKDN) |

| Two and Three-wheel Battery Electric Vehicles: · 2Ol9-2023: Minimum TKDN of 40 percent · 2024-2025: Minimum TKDN of 60 percent · 2026-onwards: Minimum TKDN of 80 percent. Four-wheel Battery Electric Vehicles: · 2Ol9-2021: Minimum TKDN of 35 percent · 2022-2023: Minimum TKDN of 40 percent · 2024-2029: Minimum TKDN of 60 percent · 2030-onwards: Minimum TKDN of 80 percent |

Key Risk/Opportunity

Electric car development in Indonesia will still experience several unresolved obstacles shortly. Industry risks that may be experienced are:

- Only Become a Local Player

The World Bank in its study entitled "Global Economic Risk and Implications for Indonesia" (2019) emphasized that the country would have difficulty exporting electric vehicles since it is not part of the global supply chain for the development of environmentally-friendly vehicles. The global lender reminded that integrated cross-country relations are necessary for the context of exports.

Some of the obstacles referred to by the World Bank include the quality of human resources, expensive import costs (components), and limitations on the Negative List of Investment in logistics.

- Lacks of Production and Infrastructure Chains

An essential component in the electric car industry is the battery, which has yet to be developed in Indonesia. The most direct shortcut to overcome this drawback is to import completely built-up vehicles, amid less-favorable trade deficits.

Additionally, the Public Electricity Provider Station (SPLU) mandated by PT PLN is still limited as well. The state-owned company claims to have established in 1,600 points across Jakarta, in which the location can be checked through Google electric vehicle. At present, PLN has set a tariff for electric vehicles recharging by Rp 1,640 per kWh.

- Inadequate Regulation

Until now, the government had only issued a regulation for the legal basis. However, the regulation details, which were later released through a Ministerial Regulation, specifically in the fiscal sector, have not yet been targeted for completion.

In addition to regulations in the financial sector, the completion target for transportation-related laws has not been set. These regulations are necessary as certainty in the development of the electric car industry in Indonesia.

Key Players

Several companies have expressed their readiness to enter the electric car industry. Among others are:

PT QMB New Energy Materials

PT QMB New Energy Materials is a company formed by the cooperation of five companies from Indonesia, Japan, and China. They are GEM Co. Ltd., Brunp Recycling Technology Co. Ltd., Tsingshan, PT IMIP, and Hanwa. On January 10, 2019, the company established an electric vehicle battery manufacturing plant at the Indonesia Morowali Industrial Park (IMIP), with investment consortium value reaching US$ 700 million.

The plant, which was inaugurated by the Coordinating Minister for Maritime Affairs Luhut Binsar Panjaitan, is a hydrometallurgical technology-based smelter project and is expected to allow Indonesia to host the battery industry development for electric vehicles.

PT QMB New Energy Materials has 50,000 tons of nickel and 4,000 tons of cobalt production capacities, allowing the company to produce 50,000 tons of nickel hydroxide intermediate products, 150,000 tons of nickel sulfate crystal batteries, 20,000 tons of cobalt sulfate crystal batteries, and 30,000 tons of manganese sulfate crystal batteries.

BYD Auto - Bakrie Autoparts

Bakrie Autoparts is a subsidiary under Bakrie Brothers. The company has been supplying several car components, including brakes. The company plans to produce 1,000-2,000 units of buses per year through its manufacturing plants located in Bekasi, Balaraja, and Lampung.

Meanwhile, BYD Auto is a China-based automotive company that produces electric cars and their components, especially batteries. BYD electric car products have been exported to Europe and the United States, including to Indonesia. Taxi operator PT Blue Bird Group has been using one of BYD line ups, the BYD e6, for its taxi fleets.

BYD e6 is also exported to Malaysia, Singapore, and Thailand. With its 80 kWh battery capacity, BYD e6 is capable of carrying passengers up to 400 kilometers on a single charge.

Hyundai Motor Company

South Korean car manufacturer, Hyundai, had talked with President Joko Widodo to express their interest in developing the electric car industry in Indonesia. The company plans to manufacture several products in Indonesia, ranging from SUVs, MPVs, hatchbacks, and sedans.

To realize the plan, Hyundai will build two manufacturing plants in Karawang, West Java, and somewhere in Central Java with a total investment of approximately US$ 1 billion.

The company plans to start production in 2021 with a capacity of 70,000-250,000 units per year. Some 47 percent of these products will be sold in the Indonesian market, while the rest is exported.

- 1 of 5

- Next