Summary

- EV financing prospect is bright, as 70 to 80 percent of auto sales in Indonesia are in credit. Multifinance set a high target for EV financing as the market showed enthusiasm for the new energy vehicle era. Without cash subsidies and a lack of infrastructure and limited EV models, EV sales contributed around 15 percent to this year's car sales growth in Indonesia.

- The Financial Authority policies on battery electric vehicle (BEV) financing, including lower risk-weighted assets obligations and discounted administrative fees for green bond issuance, could result in lower rates of consumer financing for EVs than the Internal Combustion Engine (ICE) vehicle ownership.

- The new energy vehicle era challenges multi-brand multifinances as some EV producers use their own multifinance companies to create a closed-loop business.

- However, the EV era creates new corporate and consumer financing opportunities, such as for EV supply chains and charging stations development to home chargers and battery ownership.

Background

More countries are entering the new energy vehicle era, with Indonesia is on the race with Thailand to win the position as the electric vehicle (EV) hub in Asia. This development brings opportunities and challenges to the existing auto financing industry as these countries compete to create a domestic market to attract EV-related investment.

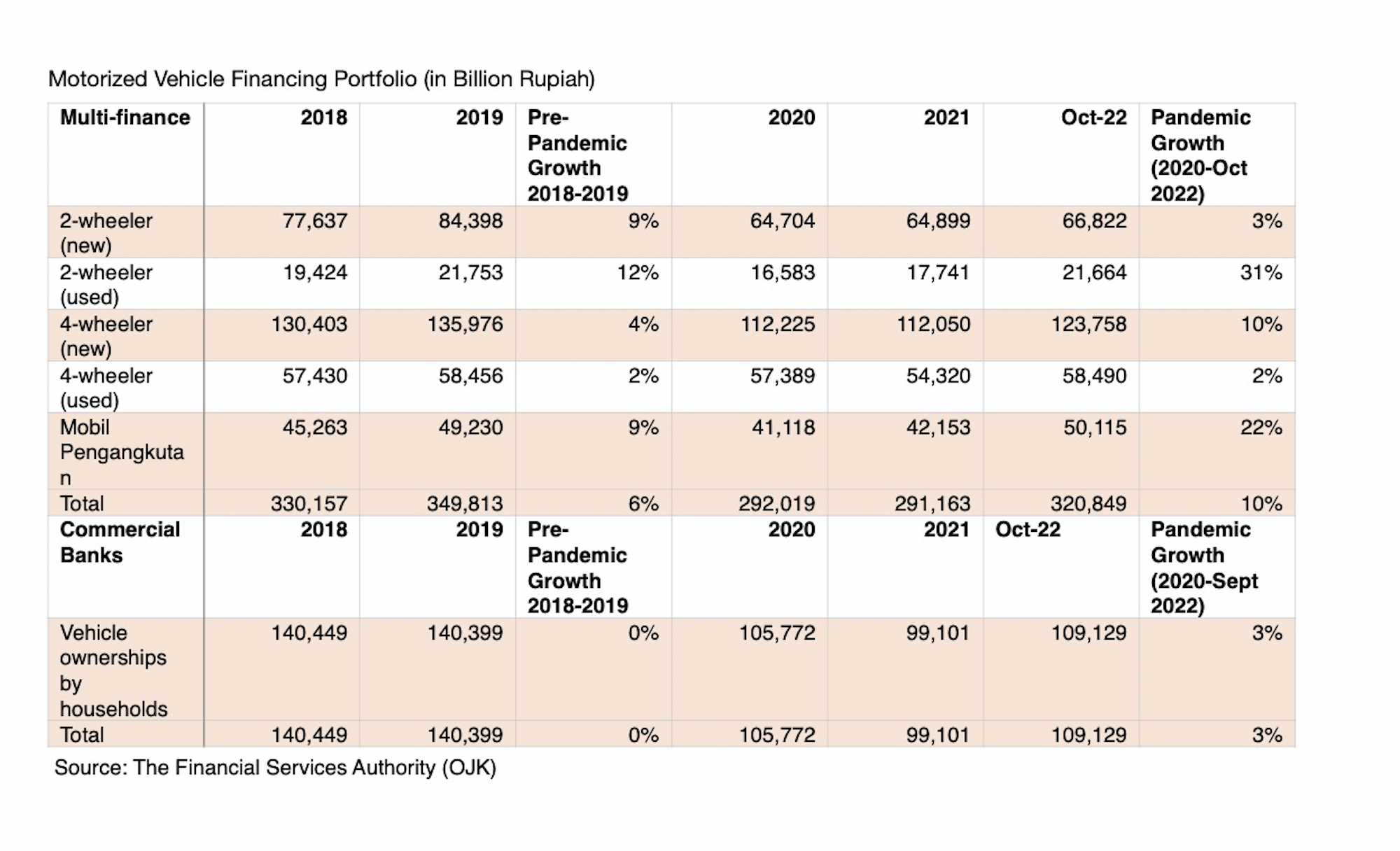

For the record, before the pandemic hit, domestic car sales had reached over 1 million units, and motorcycle sales were over 6 million units in Indonesia. Citing local auto associations data, around 70 percent of car sales and 80 percent of motorcycle sales are in credit. As of Nov 2022, the multi-finance industry has Rp 349 trillion of motorized vehicle financing portfolios or 82 percent of its total financing portfolios. Meanwhile, as of Sept 2022, banks held Rp 140 trillion in motorized vehicle financing portfolios or around 2.5 percent of their credit portfolios.

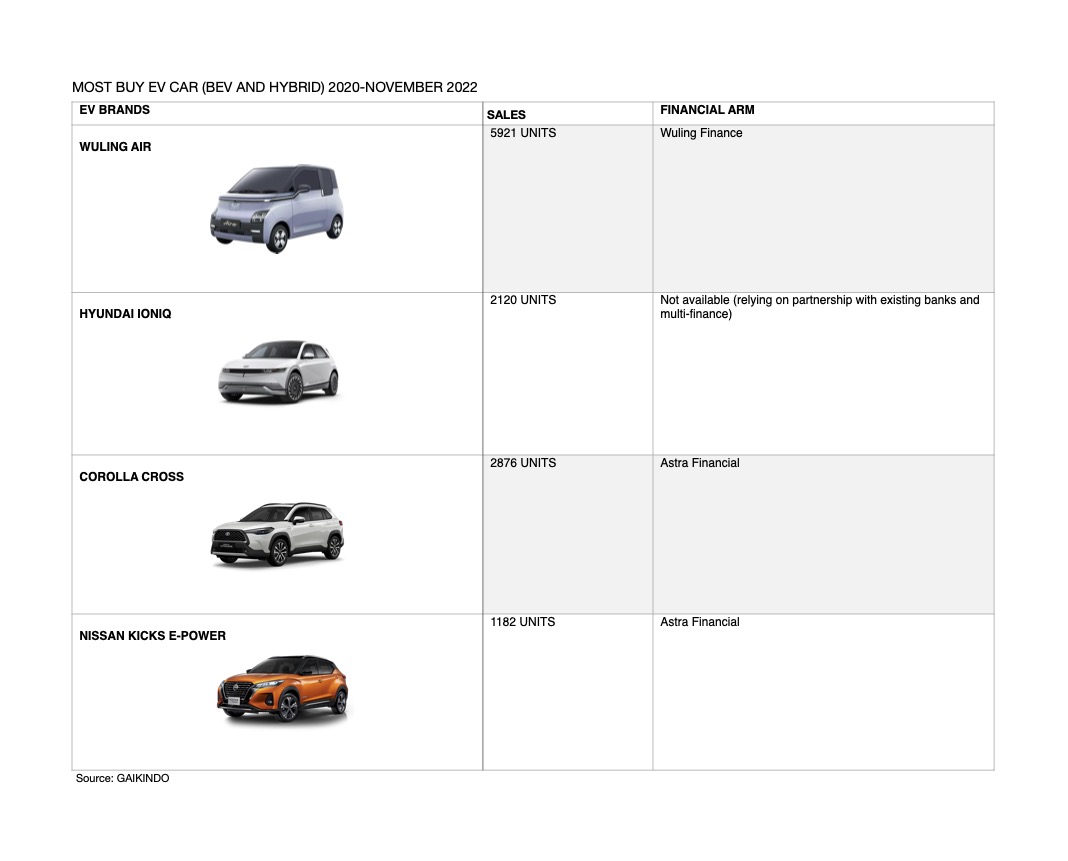

The surge in EV sales in the country in 2022 has contributed to a rebound in total car sales. Without cash subsidies, minimal infrastructure, and limited models, EV car sales from Jan to Nov 2022 were recorded at 11,975 units, four times compared to 2021. This figure is only one percent of total car sales to dealers (wholesale) but contributes around 15 percent to wholesale growth of 6.23 percent.

EV sales' future contribution to total motorized vehicle sales is prospectively higher as new incentives are in the pipeline. The Indonesian government just released new incentives and is preparing more incentives to lower EV adoption costs and further push EV sales. Recently, the Financial Authority (OJK) relaxed the risk-weighted Assets obligation for Battery Electric Vehicle (BEV) financing by multifinance, which was previously only given to BEV financing by banks. The authority also discounted administrative fees for green bond issuance by multifinances and banks. These two policies aimed at lowering EV financing rates.

Meanwhile, incentives in the pipeline include cash subsidy in the range of Rp 40 million to Rp 80 million per unit for the purchase of electrification cars hybrid and BEV, and Rp 5 million to Rp 8 million for the conversion of motorcycle engines, or the purchase of a new electric motorcycle. The government is also planning to free up import duty and sales tax for lithium battery raw materials to accelerate EV battery production in the country and provides cheaper EV battery for the domestic market.

Taking China and Thailand as a reference, the cash subsidy is proven to effectively boost EV adoptions because it directly cuts down the price and makes it as affordable as conventional vehicles or ICE vehicles. China has provided cash subsidies for over 12 years and is the biggest EV market in the world. Meanwhile, Thailand announced a cash subsidy for BEV in the second quarter of 2022 and saw a jump in EV sales.

In Indonesia, EV financing is much supported by state-owned banks and multifinance. Still, there is a trend that EV producers to use their own financial wing to provide that financing to their customers. Hyundai and Wuling, which took an early step in selling BEV cars in Indonesia's market and leading BEV sales in the country, have their own financing and insurance companies in their international market.

However, Hyundai has not brought its financial wing to Indonesia and relies on a partnership with multiple financial companies, including state-owned multifinance such as Mandiri Tunas Finance. Meanwhile, Wuling has already operated its financial wings known as Wuling Finance and Wuling Insurance since 2018 and saw a significant drop in Wuling Finance's financial loss in 2021.

For now, Astra International, which holds the license for distributing and producing multiple Japanese cars and motorcycles, is leading the auto financing market through its financial wing Astra Financial through companies namely Astra Credit Company and Toyota Astra Finance. Its rival is BCA Finance, a multi-brand multifinance owned by the largest private bank in Indonesia Bank Central Asia (BCA).

Astra Financial through FIF Group is also the leading player in motorcycle financing with rivals including Adira Finance, a subsidiary of Bank Danamon from the MUFG Group. However, some electric motorcycle producers are also on their way to developing their own financing companies. According to local auto association data, the average monthly sales of electric motorcycles in Indonesia was around 24,000 from Jan to Oct 2022, or less than one percent of total motorcycle sales of about 5 million.

Regulation Framework

1) OJK Policies to Support BEV Financing

The Financial Services Authority (OJK) relaxes the risk-weighted assets (RWA) requirement for BEV production and sales financing to 50 percent, valid until Dec 31, 2023. Meanwhile, the minimum down payment for BEV is set at zero percent. OJK has also relaxed the credit quality assessment for EV ownership financing and EV industry financing with a ceiling of up to Rp 5 billion. Banks and multifinance companies can only carry out a credit assessment based on the promptness of loan principal or interest payments.

OJK excludes the financing for BEV production and infrastructure from the Legal Lending Limit (BMPK) regulation, which refers to the maximum amount of money a financial institution can lend to a single borrower. Furthermore, OJK allows loans for BEV ownership or upstream BEV industry as sustainable finance.

In addition, OJK gives a discount on green bond registration fees of 25 percent of the original fee. Meanwhile, the Indonesia Stock Exchange (IDX) discounted the green bond's annual listing rate by 50 percent of the original rate.

2) Government Regulation No. 74/2021 on Sales Tax on Luxury Goods (PPNBM) for Motor Vehicle

Starting Sept 2021, BEV is the only type of vehicle that is free from sales tax on luxury goods (PPnBM). Meanwhile, PHEV and HEV are subject to PPNBM at a rate of 15 percent on a tax base (DPP) of 33-46 percent on selling prices and ICE vehicles. Previously, the PPnBM-free policy applied to BEV, HEV, and PHEV. The policy changes were aimed at boosting BEV sales.

3) Presidential Regulation No. 55/2019 on the Acceleration of the Battery Electric Vehicle Program for Road Transportation

This regulation is the primary legal basis for the BEV development for road transportation. In this regulation, the central and regional governments promise fiscal and non-fiscal incentives for national-brand electric vehicle development companies, namely the Battery Electric Vehicle, which uses signs, images, logos, names, and words portraying Indonesian characteristics and complies with domestic content rules.

For the record, the battery electric vehicle industry is also included in the list of industries that can get various tax facilities as stipulated in a series of regulations related to new investments: tax holidays or mini tax holidays (Law No. 25/2007, Minister of Finance No. 130/2020, BKPM Ministerial Regulation No. 7/2020), tax allowance (Government Regulation No. 18/2015 in conjunction with Government Regulation No. 9/2016, Minister of Industry Regulation No. 1/2018), as well as super tax reductions for research and development activities (Government Regulation No. 45/2019, and Minister of Finance Regulation No. 153/2020).

4) Presidential Instruction No. 7/2022 concerning Acceleration of Use of Battery Electric Vehicles by Government Agencies

This presidential instruction does not only contain commands for central government agencies and local governments to prepare regulations and budget allocations for accelerating the use of battery-based electric vehicles as official vehicles. It contains a series of other essential instructions to encourage the acceleration of the widespread use of battery-based electric vehicles by the public.

Here are some of those essential instructions:

- The Ministry of National Development Planning is commanded to prepare a plan for accelerating the use of battery electric vehicles and developing the battery-based electric vehicle industry and its ecosystem in an integrated manner. In addition, preparing a scheme or transition of subsidies from previously being given to users of BBM vehicles to being battery-based electric vehicle users.

- The Coordinating Ministry for Maritime Affairs and Investment is ordered to develop an investment acceleration strategy in the form of ease of doing business to support the production of battery-based electric vehicles from upstream to downstream and the use of these vehicles.

- The Ministry of Energy is ordered to provide convenience and acceleration of business licensing for the establishment of Electric Vehicle Charging Stations (SPKLU) and Electric Vehicle Battery Exchange Stations (SPBKLU).

- The Ministry of SOEs is asked to encourage SOEs to increase the use of battery electric vehicles and push PLN and Pertamina to synergize with other SOEs to prepare charging stations and battery exchange stations in toll road rest areas, airports, ports, train stations, tourism areas, and existing fuel stations managed by SOEs and encourage state-owned banks to provide easy financing for battery electric vehicles.

- Regional heads are asked to provide regulations to accelerate the use of battery-based electric vehicles, including fiscal and non-fiscal incentives.

5) Regulations in Consideration: Cash Subsidy for EV and Exemption of Import Duty for Lithium Battery Materials

The government is considering additional policies to support the EV industry. The first is a cash subsidy for purchasing electric motorcycles and converting motorcycle engines from conventional to electric. The government plans to subsidize Rp 8 million per unit for new electric motorcycles and Rp 5 million per unit for engine conversions. The same policy is also being considered for electrified cars, namely a cash subsidy of Rp 40 million per unit for the hybrid type and Rp 80 million for the BEV type. This policy is expected to start in 2023. The subsidy budget comes from the potential savings in fuel consumption from the adoption of EVs.

Another policy in the pipeline is the exemption from import duties and VAT for imported raw materials that support local lithium production. The government expects battery factories in Indonesia to start production in 2024 so that Indonesia can supply EV batteries at lower prices for the domestic market, in addition to starting to export these products.

Risk and Opportunity

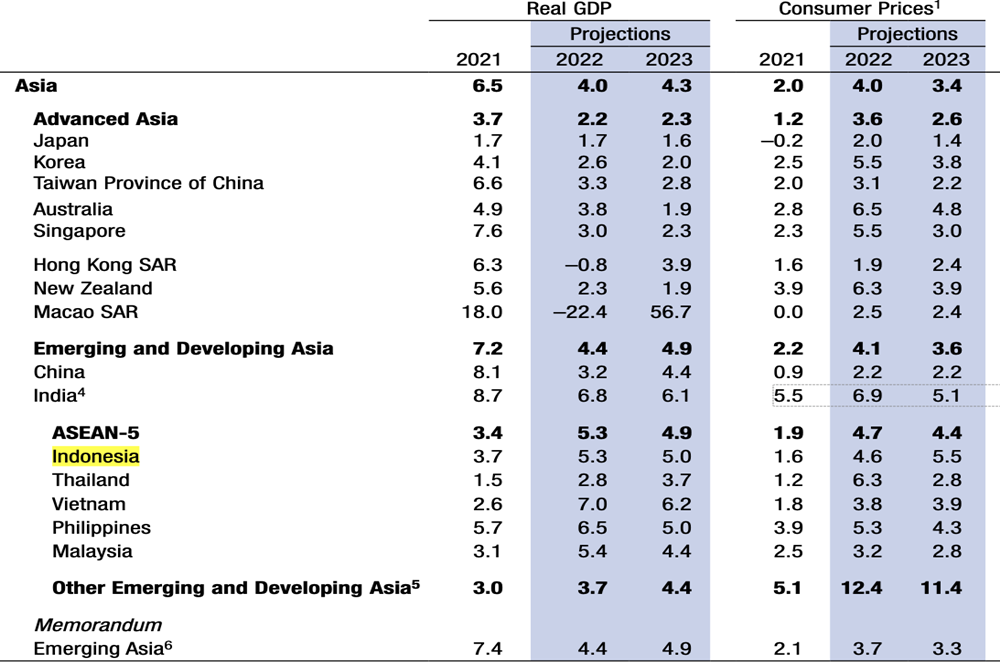

1) Higher Interest Rates and Economic Slowdown

The higher interest rate can give pressure on auto financing growth ahead. Along with the hike in global interest rate, the BI 7-Day Reverse Repo rate is projected to reach six percent in 2023, or back to the pre-pandemic rate. The Association of Indonesia's Automotive Industry (GAIKINDO) predicts a slight growth in car sales, from 945 thousand units in 2022 to 975 thousand units in 2023.

However, the EV sales portion to motorized vehicle sales is still possibly higher as more auto producers released their EV products. Chinese auto producers Chery and DFSK, Japanese auto producer Toyota, and Toyota's competitor South Korean Hyundai have already launched or will launch their EVs for the Indonesian market. BMW, Citroen, Volvo, and Mercedes-Benz are also planning to do so. DFSK will only sell EVs starting in 2023.

IMF's World Economic Outlook

Multifinance's cost of funds is relatively higher than that of banks because multifinance obtains some of the funds from bank loans. However, for the EV financing segment, there is an opportunity for multifinance and banks to get cheap funds through the issuance of green bonds.

This year, state-owned companies Bank Negara Indonesia and Bank Rakyat Indonesia issued green bonds worth trillions of rupiah for sustainable financing, including for the ownership of new energy vehicles. In China, the largest market for EVs, one of its largest EV manufacturers, SAIC Motor, is releasing green bonds in the first half of 2022 to support its financial arm SAIC-GMAC in financing electric cars as well as hydrogen and other new energy cars.

3) EV Producers Close-Loop Business: Risk to Multi-Brand Multifinance

EV producers tend to build a closed-loop business by developing their financial arms to provide financial services for their customers. Some leading EV producers already have financial arms for their international market.

Wuling Motors, which leads BEV sales in Indonesia in 2022, is already heading towards a close-loop business in the country. Wuling has operated PT SGMW Multifinance Indonesia (Wuling Finance) and Wuling Insurance. Wuling Finance is a joint venture between Wuling Motors and SAIC Motor, General Motors, and the Sinar Mas Group's financial holding company, Sinar Mas Multiartha (SMMA).

On the other hand, Hyundai also has a financial arm, Hyundai Capital, besides HK Insurance and Hyundai Insurance. These financial companies potentially enter the Indonesian market in the future. In the meantime, Hyundai relies on local banks and multifinance partners to serve its customers.

Chery, returning to the Indonesian market after leaving in 2016, plans to provide EV financing for its customers by collaborating with Santander Consumer Finance, which is part of the Spanish financial group Santander Group. However, in China market, Chery begins to build its financial business. This China's largest car manufacturer in the low-cost EV segment has received permission to build an auto financing joint venture in the first half of 2022.

4) New Potential Segment in Consumer Financing

The EV era will create new corporate and consumer financings segments, such as EV supply chain financing, charging stations financing, and home chargers and battery ownership financing. While battery ownership financing can be seen as a medium-future opportunity because EV ownership is still in the initial stage, the rest can be identified as immediate opportunities. EV charging station financing opportunities emerge as electricity operator Perusahaan Listrik Negara (PLN) opens partnerships with individuals and companies to develop charging stations throughout the country.

Main Players

Four-Wheeler Financing

1) Astra Credit Company (Astra Sedaya Finance)

PT Astra Sedaya Finance was founded in 1982 as a finance company supporting sales of Astra products such as Toyota, Daihatsu, Isuzu, Peugeot, BMW, and UD Trucks. The company also provides financing for non-Astra products, but the proportion of total funding is minor. The company also has multipurpose financing for travel, umrah, education, marriage, health care, house renovation, and business capital.

Supported by Astra's dominance in car sales in Indonesia -- above 50 percent of total car sales -- Astra Sedaya Finance, along with its sister company Toyota Astra Financial Services, has become a market leader in car financing. The company's annual net income is around Rp 5 trillion, with low Non-Performing Financing (NPF) below one percent.

| Year | 2020 | 2021 | Jan-June 2021 | Jan-June 2022 |

| Net Revenues | Rp 5.74 trillion | Rp 5.55 trillion | Rp 2.75 trillion | Rp 2.99 trillion |

| Net Profit/Loss | Rp 718 billion | Rp 1.12 trillion | Rp 456 billion | Rp 678 billion |

2) BCA Finance

BCA Finance is a subsidiary of Indonesia's largest private bank, Bank Central Asia (BCA). BCA holds 99.58 percent of the company's shares. The company focuses on the multifinance industry with a dominant portfolio in multi-brand new-car financing. The company has a sister company, BCA Multi Finance, which focuses on financing new motorcycles and used motorcycles and cars.

Supported by low-cost funds from BCA, the company records Rp 3 trillion in annual revenue and profits of over Rp 1 trillion, with NPF maintained at around one percent.

| Year | 2020 | 2021 |

| Net Revenues | Rp 3.14 trillion | Rp 3.37 trillion |

| Net Profit/Loss | Rp 1.22 trillion | Rp 1.70 trillion |

3) Mandiri Tunas Finance

Mandiri Tunas Finance is a subsidiary of the state-owned bank Bank Mandiri. The company focuses on multi-brand car financing. The company has a sister company, Mandiri Utama Finance, which focuses on multipurpose financing.

The company records annual revenue in the range of Rp 2-Rp 3 trillion. The company is one multifinance company that early enters the BEV financing segment. PT Mandiri Tunas Finance and PT Mandiri Utama Finance financed the ownership of 218 BEV cars worth Rp 58 billion during the first half of 2022. In 2023, EV financing is expected to have a portion of around 20 percent of the optimistic target of new financing of Rp 10 trillion.

| Year | 2020 | 2021 | Jan-Sept 2021 | Jan-Sept 2022 |

| Net Revenues | Rp 2.51 trillion | Rp 3.18 trillion | Rp 2.34 trillion | Rp 2.74 trillion |

| Net Profit/Loss | - Rp 299.98 billion | Rp 245.88 billion | Rp 162.82 billion | Rp 511.75 billion |

4) BFI Finance

BFI Finance is controlled by Trinugraha Capital & Co SCA. When it acquired the company in 2011, Trinugraha was owned by a consortium members, including Garibaldi Thohir, TPG Capital, and Northstar Equity. Currently, most of Trinugraha's shares are held by senior banker and entrepreneur Jerry Ng whose also one of the shareholders of Bank Jago, a digital bank affiliated with GoTo.

The company's revenue is around Rp 4 trillion, with a low NPF of under one percent. Nearly 49 percent of the company's financing assets are cars, and the rest are motorcycles and others.

| Year | 2020 | 2021 | Jan-Sept 2021 | Jan-Sept 2022 |

| Net Revenues | Rp 4.57 trillion | Rp 4.12 trillion | Rp 2.97 trillion | Rp 3.85 trillion |

| Net Profit/Loss | Rp 702 billion | 1.13 trillion | Rp 796 billion | Rp 1.31 trillion |

5) Wuling Finance

SGMW Motor Indonesia (SAIC-GM-Wuling Automobile) and PT Sinar Mas Multiartha jointly own PT SGMW Multifinance Indonesia, with the majority of shares held by SGMW.

The company's business activities focus on consumer financing for purchasing new cars, specifically for the Wuling and Morris Garage brands.

Wuling Finance has not recorded a profit since founded in 2018. However, the company's financial performance continues to improve as sales of Wuling cars increase. It recorded a loss of Rp 47.758 billion, a drop of more than 50 percent from Rp 114.173 billion in the previous year. This drop is in line with soaring revenues. The company's performance should be better in 2022, supported by sales of conventional vehicles and BEVs.

| Year | 2020 | 2021 |

| Net Revenues | Rp 114.52 billion | Rp 178.30 billion |

| Net Profit/Loss | - Rp 114.17 billion | - Rp 47.76 billion |

Two-Wheeler Financing

1) FIF Group

Astra International controls FIF Group. The company records Rp 8-9 trillion in revenue, with the NPF maintained below one percent. The largest financing is for the new motorcycle financing segment at around 60 percent, the remaining 30 percent for used motorcycle financing, two percent for multipurpose financing, and less than one percent for car financing.

| Year | 2020 | 2021 | Jan-June 2021 | Jan-June 2022 |

| Net Revenues | Rp 9.57 trillion | Rp 8.84 trillion | Rp 4.43 trillion | Rp 4.40 trillion |

| Net Profit/Loss | Rp 1.49 trillion | Rp 2.47 trillion | Rp 948.62 billion | Rp 1.51 trillion |

2) Adira Dinamika Multi Finance (Adira Finance)

Adira Finance is a subsidiary of Bank Danamon, which MUFG Bank controls. Previously, businessman TP Rachmat held a portion of the company's shares but was later sold. The company's largest financing portion is for motorcycles and car ownership. The company's revenue is around Rp 8-9 trillion, with an NPF below one percent.

Adira Finance has disbursed Rp 2.9 billion for electric motorbikes financing and Rp 5.5 billion for electric car financing until September. The company has set a more ambitious target for EV financing next year: three to six percent of the company's new financing, or around Rp. 600 billion to Rp. 1.2 trillion.

| Year | 2020 | 2021 | Jan-June 2021 | Jan-June 2022 |

| Net Revenues | Rp 9.43 trillion | Rp 8.65 trillion | Rp 6.19 trillion | Rp 6.27 trillion |

| Net Profit/Loss | Rp 1.02 trillion | Rp 1.21 trillion | Rp 753.27 billion | Rp 1.15 trillion |

- Previous

- 5 of 5